Why you may want to sell your home

Why You May Still Want To Sell Your House After All

Even though you may feel reluctant to sell your house because you don’t want to take on a mortgage rate that’s higher than the one you have now, there’s more to consider. While the financial side of things does matter, your personal needs may actually matter just as much. As an article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal decision. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market.”

So, ask yourself this: why did I want to move in the first place?

Chances are your primary motivation wasn’t just financial in nature. Why you’re really thinking about selling likely has more to do with something changing in your life or a shift in what you need out of your house.

Reasons Homeowners Still Need To Sell Today

Let’s explore some of the most common reasons sellers are moving today. A recent article from Builder Online helps shed light on this. In this research, they identified the following categories:

- Marriage – If you just got married, you may find you either need more space than you currently have, or the two of you want to find a new place you picked out together.

- Divorce – If you’re getting separated or are divorcing your partner, chances are it’ll be difficult to live under the same roof. Selling the place you have, so you can own get your own spot, may be necessary.

- Births – If your household is growing, you may need more square footage, including more bedrooms. If you’re running out of room for everyone, you may not be able to wait to move.

- Deaths – If you’ve recently lost a loved one, it can be hard to spend time in that home. You may need to move for financial reasons or because you no longer need all the space.

- Retirement – If you’re in the process of retiring, or you just did, you may be looking to downsize to cut costs, relocate to be closer to loved ones, or move to a dream location. In this new phase of life, your current home may not be able to deliver what you need.

You may find you share one of these top motivators. If any of these resonate with you, it may be time to move so you can find a house better suited to your changing needs. A survey from Realtor.com finds other sellers are in the same boat. It says, 1 in 4 sellers are choosing to move for personal reasons, even with current mortgage rates:

“. . . more than half of seller-buyers (56%) who are planning to sell in the next 12 months said they are waiting for rates to come down, while 25% need to sell soon for personal reasons.”

If you need to sell now because something in your own life has changed, don’t let rates hold you back from what you want. You have options to help make that move possible. You can use the equity you already have in your current home toward your next purchase. And with how much equity homeowners have right now, you may be able to finance less than you’d expect, or pay all cash to avoid borrowing at all.

Bottom Line

When you’re ready to prioritize your changing needs, let’s connect. You need an expert on your side to help you list your house and find a home that delivers on everything you’re looking for.

Why Today’s Housing Market Isn’t Headed for a Crash

Why Today’s Housing Market Isn’t Headed for a Crash

67% of Americans say a housing market crash is imminent in the next three years. With all the talk in the media lately about shifts in the housing market, it makes sense why so many people feel this way. But there’s good news. Current data shows today’s market is nothing like it was before the housing crash in 2008.

Back Then, Mortgage Standards Were Less Strict

During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance an existing one.

As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies.

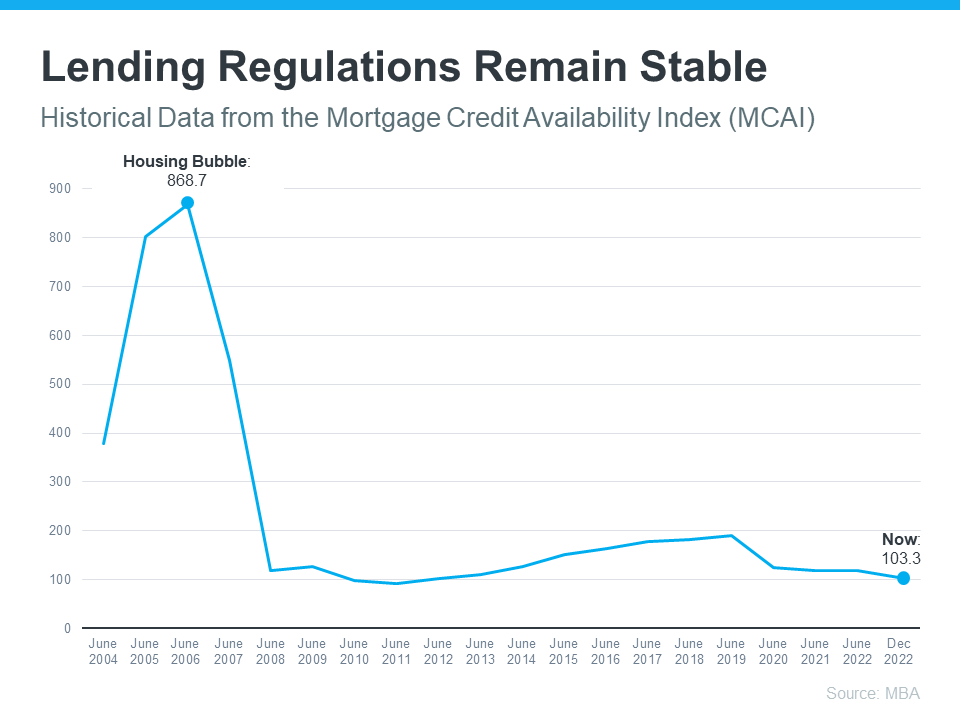

The graph below uses data from the Mortgage Bankers Association (MBA) to help tell this story. In this index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is.

This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards have helped prevent a situation that could lead to a wave of foreclosures like the last time.

Foreclosure Volume Has Declined a Lot Since the Crash

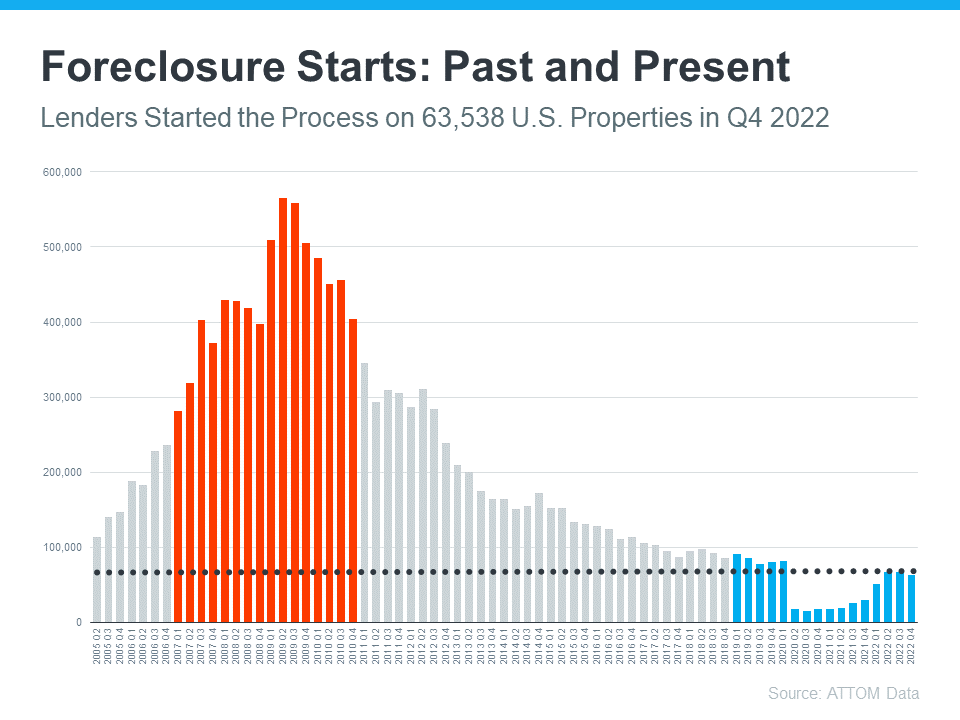

Another difference is the number of homeowners that were facing foreclosure when the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM to show the difference between last time and now:

So even as foreclosures tick up, the total number is still very low. And on top of that, most experts don’t expect foreclosures to go up drastically like they did following the crash in 2008. Bill McBride, Founder of Calculated Risk, explains the impact a large increase in foreclosures had on home prices back then – and how that’s unlikely this time.

“The bottom line is there will be an increase in foreclosures over the next year (from record level lows), but there will not be a huge wave of distressed sales as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.”

The Supply of Homes for Sale Today Is More Limited

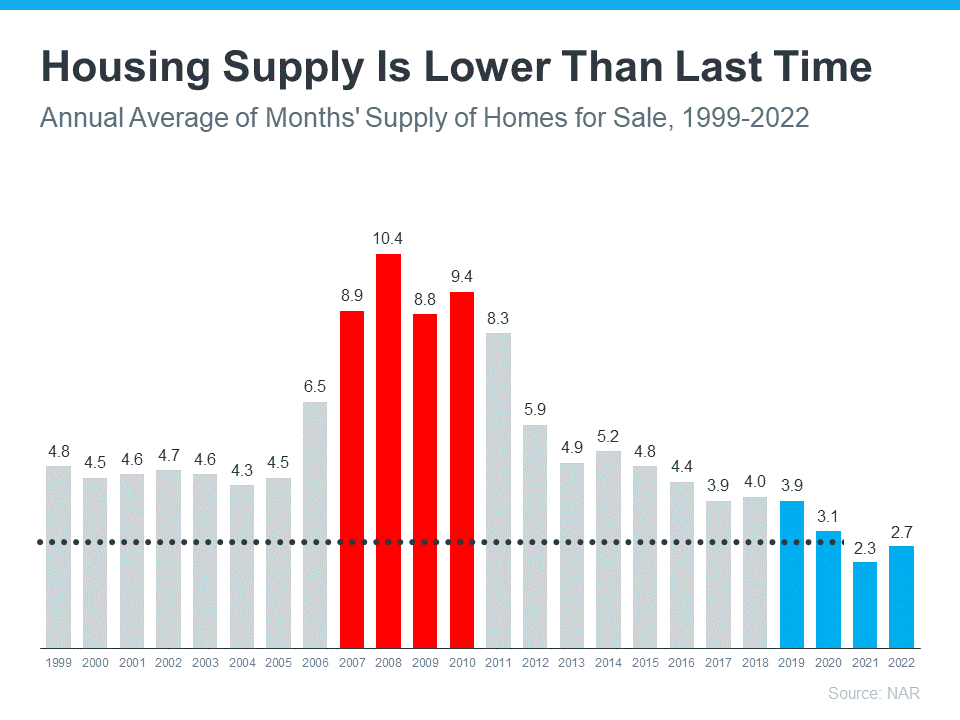

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just 2.7-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines.

Bottom Line

If recent headlines have you worried we’re headed for another housing crash, the data above should help ease those fears. Expert insights and the most current data clearly show that today’s market is nothing like it was last time.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link